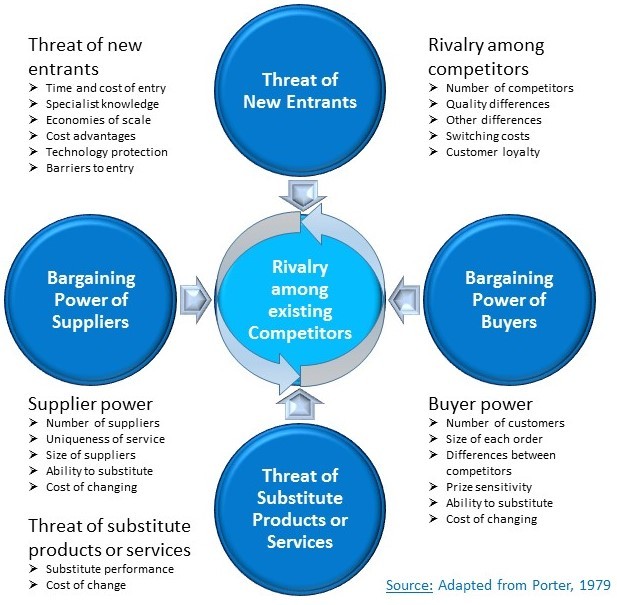

Porter's Five Forces

Porter’s Five Forces analysis attempts to help assess the organisation’s competitive position. It has similarities with other tools for environmental analysis, such as PESTEL analysis but focuses on competition. Porter’s Five Forces looks at five key areas:

- the threat of new entrants,

- the bargaining power of buyers,

- the bargaining power of suppliers,

- the threat of substitutes, and

- competitive rivalry.

Porter argues that a competitive strategy must emerge from a refined understanding of rules of competition that determine market attractiveness. He claims the ultimate aim of competitive strategy is to cope and ideally to change those rules and firm’s behaviours.

The threat of new entrants and entry barriers

-

Economies of scale such as the benefits associated with bulk purchasing.

-

High cost of entry, e.g. how much will it cost to buy a fleet of aircraft to enter the airline business?

-

Ease of access to distribution channels.

-

Cost advantages not related to the size of the company such as personal contacts or knowledge that larger companies do not own.

-

Will competitors retaliate if the price is increased or lowered?

-

Government action such as new laws that may weaken the competitive position of a company. This happened in Ireland when the taxi market was deregulated.

-

How important is differentiation? Certain brands have very loyal customers and cannot be copied.

Barriers to exit work similarly to barriers to entry. Exit barriers like specialized assets and high exit costs, limit the ability of a firm to leave the market and can intensify rivalry – unable to leave the industry, a firm must compete.

The bargaining power of buyers

The bargaining power of buyers is high where there are a few large players in a market. In such circumstances, the options for suppliers to negotiate their price are reduced. Consider the large supermarket chains that can virtually dictate the price they give to food producers. If there are a large number of undifferentiated small suppliers, such as small farming businesses supplying the large grocery chains, this adds to the power of the supermarkets as buyers.

The power of buyers is further enhanced if the cost of switching between suppliers is low, supermarkets may not incur any increase in costs if they switch food producers, even if they are in a different country. The power of individual buyers can be high if the switching costs are low, such as the case of changing mobile phone service provider when you can keep your existing mobile number.

The bargaining power of suppliers

The bargaining power of suppliers tends to be a reversal of the power of buyers. Where the switching costs are high, this increases the power of the suppliers. For example, it may be difficult to switch from Microsoft products if the other products are not compatible with the software you have on your computer. The power of suppliers is high where the brand is powerful, as is the case with brands such as Sony, Adidas, Nokia, Coca-Cola, Apple, Gillette, etc. The power of suppliers can be enhanced where the supplier integrates horizontally in the industry. For example, brewers buying pubs, motor manufactures buying food retail outlets. If customers are so fragmented that they cannot come together, they have little bargaining power, this increases the power of suppliers. An example of this is where there is only one shop in a village and the surrounding community have not or cannot come together to put pressure on them to lower prices.

The threat of substitutes

The threat of substitutes occurs where there is product for product substitution or the potential for substitution of need. An example of the former is using the ferry rather than flying. An example of the latter is buying machine-wash clothes rather than clothes that have to be dry-cleaned. There may also be generic substitution. This is where 2 different products or services might compete for the customer’s income, e.g. Cinema versus pitch and putt.

Competitive rivalry

Competitive rivalry is the extent to which competitors in the market are sensitive to the actions of each other. Competitive rivalry is largely determined by the other forces. It can be high where entry is easy, where there is easy substitute of products and services, and where suppliers and buyers attempts to control the market. The intensity of competitor rivalry increases with:

- A larger number of firms

- Slow market growth

- High fixed costs

- High storage costs

- Low switching costs

- Low levels of product differentiation

- High exit barriers

Common strategies for protecting market share include:

- Altering pricing policies

- Improving product differentiation

- Seeking ways to use channel distribution more creatively

- Exploiting relationships with suppliers

- Improving service levels

Porters Five Forces model was developed in an environment that was quite different to the one organizations find themselves operating in today. Despite its considerable influence, Porter’s 5 forces of competition has been quite heavily criticised by practitioners and academics for its inherent weaknesses. They point out that it assumes a classic perfect market (which rarely exists), fails to provide for regulated markets, simplifies the dynamics of most markets, assumes a relatively static market and does not consider important issues such as strategic alliances and shared technologies.